The check engine light of the economy is on with no AI mechanic in sight.

What the job reports, AI companies, and S&P 500 have to do with you and me.

When the check engine light comes on in your car, it’s time to take a look under the hood. Probably replace something. The problem could be small, or large, but we all know that if left unchecked, it will likely amount to bigger problems later.

The check engine light for the US economy (early recession indicators as the internet likes to call them) has been on for a while, and it seems the light has been duct taped over to make the problem go away.

Things Feel Unstable

Something feels off in the US economy. The headlines say unemployment is low-ish (4.3%) and that the markets are soaring. At the same time, we’re learning that the number of people unemployed is greater than open jobs available for the first time since recovering from the pandemic, inflation is not slowing down (nor captured accurately by CPI), and for most people, life feels more precarious than ever. Wages are even beginning to decline in some states. What used to be called job tenure is now deemed “job hugging,” as workers are terrified to leave even mediocre roles because of job market instability.

Then you add in the “AI Bubble.”

This all results in an economy increasingly detached from real work, intentional intervention, and lived experience. I have never felt very represented by the stock market anyway, but I didn’t think I could feel this far removed.

I was waiting to publish this until I had solutions, but that might be a while. For now I want to bring awareness, transparency, and clarity to what I see going on, mixed in with a bit of speculation.

Holes in the Data

The government has been shut down since October 1st because of arguments over the government funding bill, which has to be passed every October for the Feds fiscal year (Oct-Sept). Because of this shutdown, the Bureau of Labor Statistics (BLS) hasn’t been releasing new data typically scheduled to release, like the jobs report. This is convenient timing for them, as the data they’ve been releasing has been facing extreme heat over its inaccuracies and false narrative.

For example, the BLS released an updated jobs report for data from March 2024-2025, and the data showed 911k less jobs than were initially reported. People are not happy with how off these initial estimates were, casting skepticism on their data collection methods.

Youtuber ClearValue Tax breaks down in this video the holes in the data clearly. Some things to know when evaluating BLS Consumer Price Index data is that they use a Substitution Effect and Hedonic Adjustments. The first assumes people will switch to cheaper goods when prices rise, and the second removes price increases attributed to “quality improvements.” This means you as the consumer must always opt to buy the cheapest options available to stay aligned with CPI, and that if prices go up, let’s say for a smartphone, those price increases are left out of the CPI because they’re quality improvements. Many items could fall under these categories.

Therefore, even if August CPI data shows a 2.9% increase in all goods year-over-year, your bills and the average costs for things you purchase have likely gone up much more than these numbers capture. CPI doesn’t accurately reflect inflation anyway, as this is truly measured by money floating around in the economy - which the Federal Reserve has a print order to print anywhere from 3.8 to 5.1 billion notes for the 2026 calendar year.

Employment Signals

From the 911k jobs that were cut for 2024, the greatest markdowns were seen in hospitality, professional and business services, and retail trade, but most sectors saw markdowns - except transportation and warehousing and utilities.

So far in 2025, companies have announced 946k job cuts. This is expected to surpass a million by the end of the year. Periods with similar job cuts were experienced during recessions or first waves of automations that cost jobs. Of these job cuts, 293k are attributed to DOGE actions, 208k to market/economic conditions, 144k to closings, 100k to restructuring, and only 17k were attributed to AI. We’ll touch on that more later.

Hiring for retail is a significant indicator for how the economy is doing. In the first five months of 2025, retail jobs were cut by 274%. In relation to the labor market, if not enough people are working or have steady income, then consumption goes down. If we’re already seeing these retail job cuts, that indicates these large companies are forecasting consumer spending to tighten. Firms like PwC are projecting holiday sales to decline this year, with other experts stating retail hiring this year could see its lowest point since the 2009 season.

While BLS data is stalled, we can look to private data companies, like ADP and Revelio Labs, for their job reports.

ADP reports that in September net private employment decreased by 32k jobs. They also reported the gap between the lower-income earners and highest-income earners widening.

Revelio Laps reported jobs postings and salaries from new job postings decreased in September, by .6% and 3% respectively. They did say the Retail sector showed employment gains of 40k jobs though, somewhat countering the other predictions for retail hiring, but still low when compared to prior seasons.

If job numbers continue to go down, the Feds will be pressured to cut interest rates again, risking increased inflation.

Market Fragility

Savings Down, Debt on the Rise

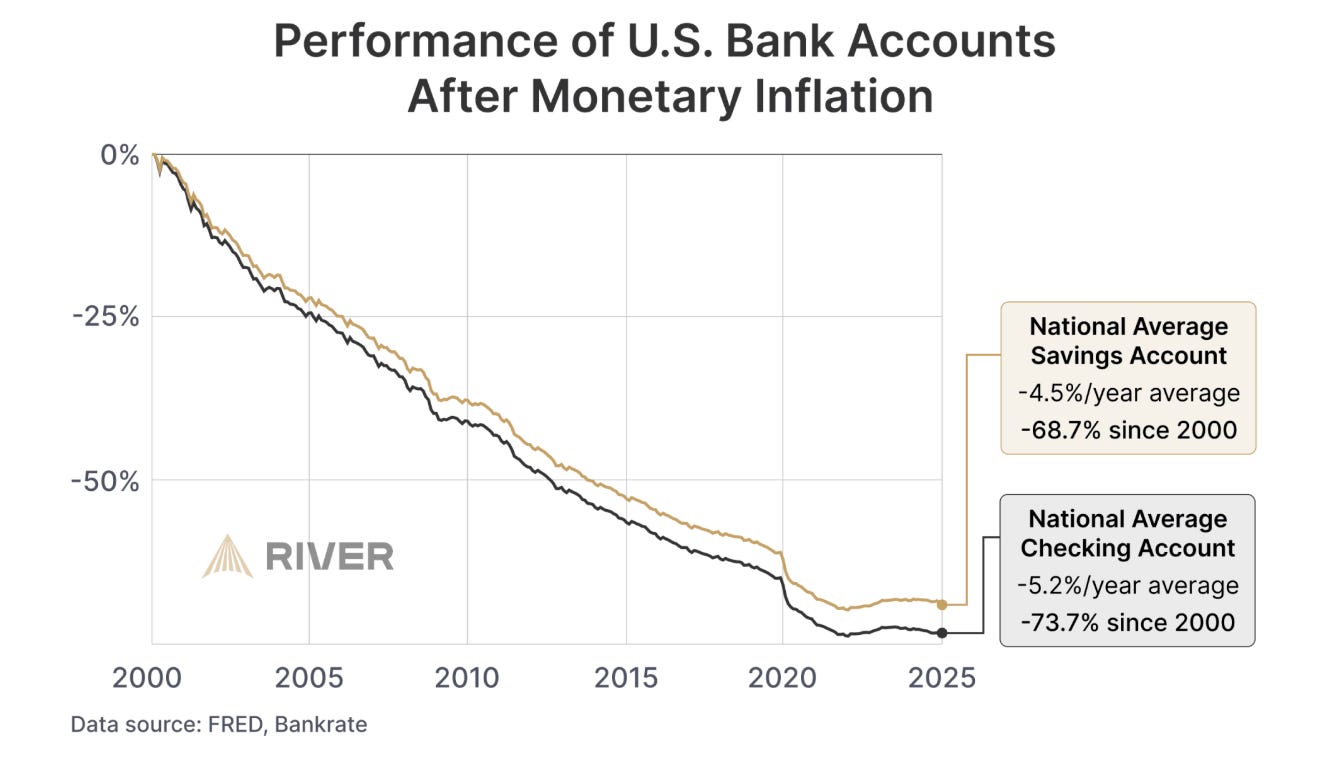

Average US bank account savings have been eroded by nearly 70% since 2000.

Not only are people depleting their savings, they are leaning on credit to finance their continued spending.

In Q2 of this year, US household debt reached $18.38 trillion (T). $12.9T of that is mortgage debt. $1.21T is credit card debt, up 5.8% from the same time last year. About $1.64T is student loan debt. Delinquency rates on credit card payments have been climbing since 2021. With a weakening job market, these problems are likely to exacerbate.

If you take a look at the overall US economy, things seem to be doing great!

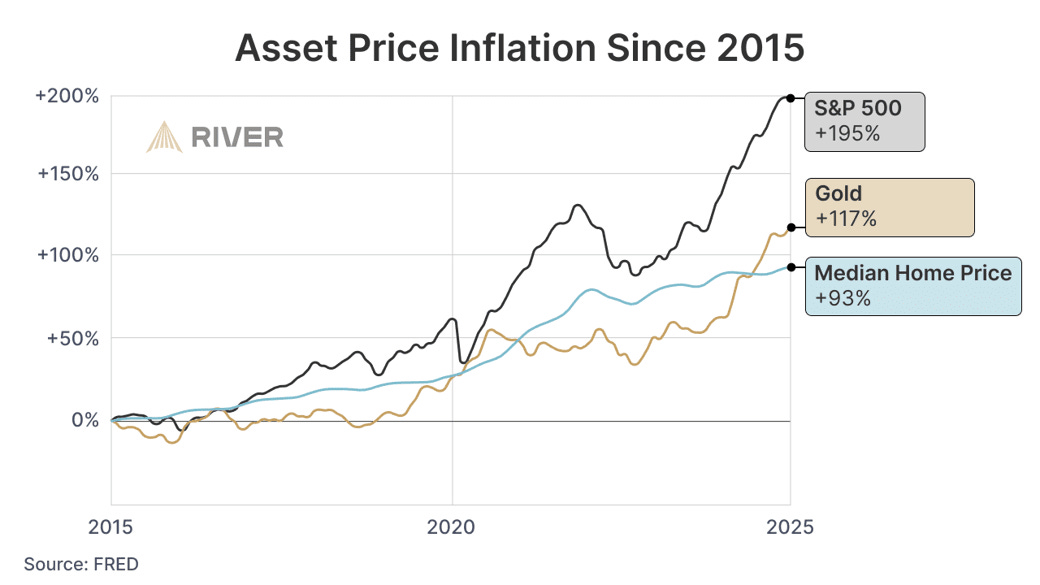

The S&P 500, which is used to widely capture the value of shares for all the biggest companies (top 500), is up 195% over the last decade. Median home prices continue to go up. Meanwhile, the price of gold is also growing. This is unusual as typically the price of gold goes up when confidence in the US dollar is weak - to offset the risks. But now, the prices of both are going up, signaling confidence in the market and distrust in the value of the US dollar.

Debt as Asset-Backed Securities

Just like the banks have done before, these loans and debts that we’re piling up are being packaged and sold as non-liquid assets to investors to give them more investing money. They’re called “asset-backed securities”, and they can be risky. Asset-backed securities were a large contributor to the housing bubble collapse.

As soon as people begin to default on their debt, which could happen at any time, the dominoes begin to fall. The revenue investors were expecting never comes in. The same revenue that investors already sold to other investors, who already sold to more investors.

Putting it as simply as I can, here’s an example: a bank holds a total of 100k in consumer debt with maybe 10% returns = $110k. It securitizes that debt and sells it to an investor. That investor, now with $110k in theoretical money, buys shares of some companies for its clients. Now these companies’ share values have been inflated by the additional $110k, adding to market confidence, leading to even higher valuations. Those companies go and invest with their new money, maybe promise to buy some chips, and now everyone is richer! All because of our debt. The cycle continues. There’s a lot of this going on right now.

As soon as the debt is defaulted on, all of the companies involved lose that money, because it was never there in the first place. The system only keeps working if no one gets shook and people keep betting on the ability of consumers to pay off debt and not default. If the non-liquid assets can stay non-liquid and no one cashes in.

But, things are getting pretty tight… and people can’t pay back debt if they don’t have.. JOBS.

We’ve all known this. We’ve all been feeling it. But as soon as doubt starts to make its way into the minds of the people who control the stock market and investments, they start to feel it too. Investors start hedging - betting on the downfall rather than the continued growth of certain markets.

The AI Bubble

Invest and forget the rest

Now we get to what’s been all over the news - the AI Bubble.

Silicone Valley investors have been racing each other to pioneer the AI space and fund all of the startups because that’s where the money is! THE FUTURE! No one wants to be late to the future.

Before it was AI, it was the housing bubble. Before the housing bubble, it was the dot com bubble, which closely mirrors the technological effects on the economy we’re feeling now in regard to higher automations and job disruptions.

What’s interesting about the AI bubble is that it has made up nearly 40% of US GDP growth this year. GDP is the value of goods in the US market, calculated by summing consumer spending (that’s us!), business investment (that’s them!), government spending (also them!), and net exports. This means AI investments (not consumer spending, but them spending money on each other in order to make profit later) are making up 40% of growth in the market, which makes everything look and feel good to (them!)

Because the money is flowing! But not from consumer spending. Or earnings.

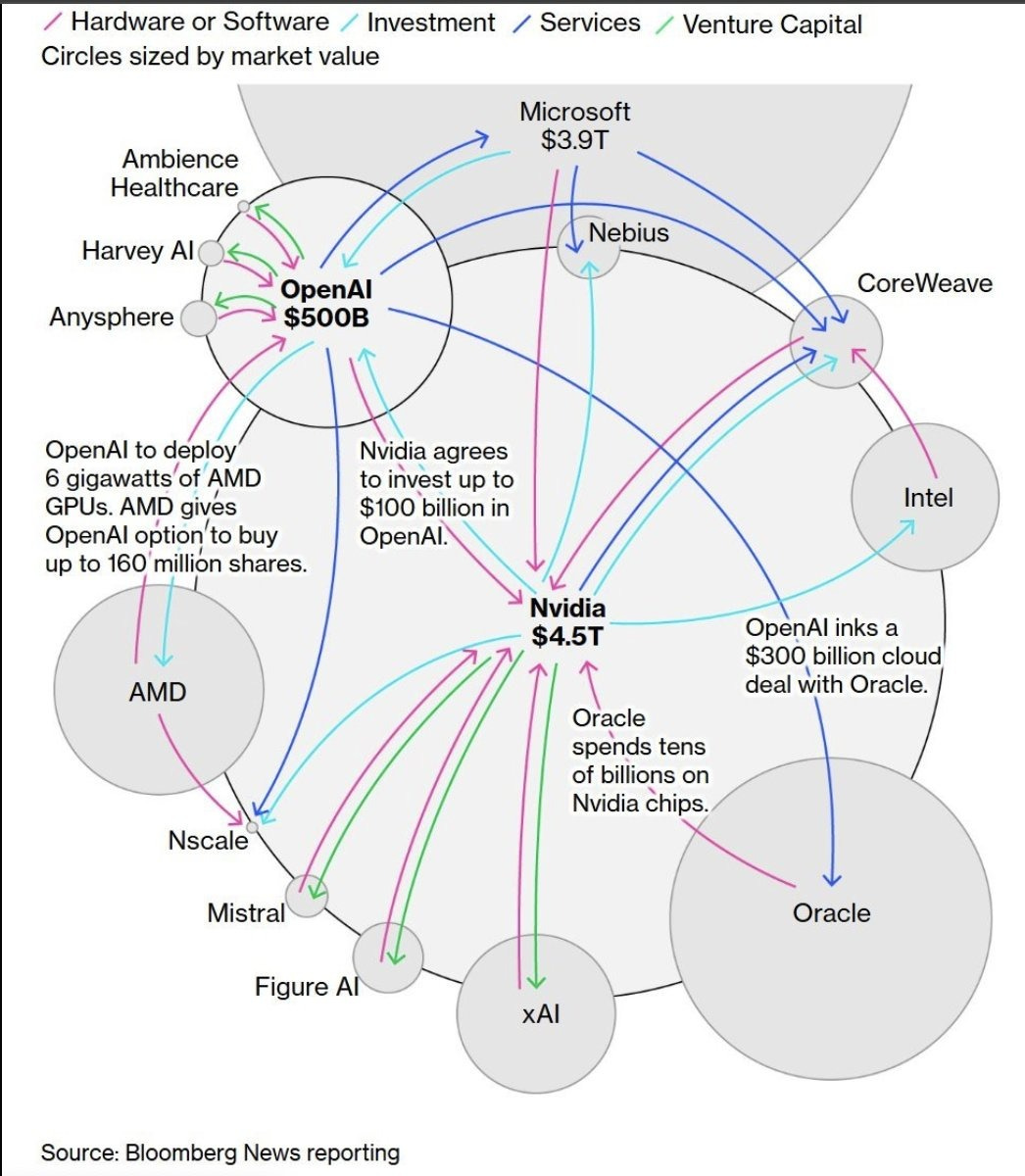

This graph from Bloomberg has been circulating, illustrating how many AI-related investments are effectively circulating within the same small group of companies. The issue is that when one company “invests” in another, it often boosts both firms’ valuations and expands the recipient’s perceived investment capacity. In many cases, these “investments” are really purchase commitments, aka promises to spend on each other’s products or services, which still boosts values. The result is a cycle where companies keep inflating each other’s valuations without generating corresponding revenue or profits, spending money they haven’t made. This creates the illusion of growth in the stock market without their being any real earnings yet.

Spending and investing only look good until… investors expect consumers to step in and do the spending - so that the tech companies can pay off their debts and they all get their returns.

If I’m not making money, I’m not paying off debt. If AI tech giants aren’t making money, they’re not paying off their debt either.

Maybe I can relate with the stock market after all 🩶

So… are the AI tech giants making money yet?

Corporate Demand for AI

The fear that’s been spread, mostly by AI companies themselves, is that AI will “wipe out half of all entry-level white collar jobs in the next one to five years.” Similar projections are floating around, trying to prepare the workforce for the lack of jobs to come and the need to invest in AI skills and other tech in order to keep up. While learning those skills is important, we haven’t seen many of these layoffs due to AI yet. Like mentioned, of the 946k jobs that were cut, 17k were attributed to AI. That’s about 1% of the cut jobs.

Of course, these numbers don’t capture the hiring freezes many companies have been conducting. As we’ve discussed, there are several factors affecting the limited number of entry-level jobs available, not just AI incorporation. But, many of the companies who have adopted AI to replace people are now scrambling to hire back workers on contract (or gig work) to fix the data and reports produced by AI. Oof.

The US Census Bureau also reported that there has been an obvious drop in corporate AI use since they started the survey in November 2023. Not only that, but 95% of corporations that have adopted AI state the software hasn’t created any new forms of revenue.

And how could I forget to mention that Deloitte is having to pay back the Albanese and Australian governments for reports they were hired to provide that contained errors and fake references? Yes - they admitted to using AI to create the reports.

Doesn’t look like AI will be replacing all of the workers yet.

But if it did, what’s the plan there? Who benefits?

To be clear, I’m not completely against the use of AI. I think it can be an additional tool to utilize like any other innovation in tech we’ve experienced before. I just want to make sure we’re approaching this rationally, yeah?

Consumer Demand for AI

Truth is, AI is a product of the future, and no one knows what to do with it today. It hasn’t quite advanced to where it can replace talented and skilled workers. We’re in a sort of stalemate where the technology needs to advance incredibly in order to recoup costs and be worth while. Getting the tech to a place where it can replace skilled workers will take trillions more dollars. By the time the tech is here, will it be able to generate enough revenue to pay back the trillions of dollars in investments?

The Economist reports that global spending on AI hardware and software reached almost $1T in 2024. They’re predicting it will double to $2T in 2026. Considering much of the tech the investments go into (chips, energy, data centers, etc.) depreciate in value within 3-5 years, the companies will need to invest more to replace the outdated tech. The depreciation will also cut into potential profits and revenue (at least it’s a tax write-off). If the tech was replaced every three years, the Economist estimates this could cut net profit for the AI giants by the trillions in the same amount of time. An accountant’s nightmare.

This means the tech companies need to generate trillions of new revenue, starting soon, to break even.

This Substack post insightfully breaks down how the wave of AI infrastructure spending will require $2T in annual revenue by 2030 to justify its spending. The post dives into how these companies are primarily making money through subscriptions and data center usage. These revenue streams generate nowhere near what the companies need, so now… they’re creating new social media apps. Yikes. I won’t bother listing these apps.

They’re trying to tap into the “attention economy” which makes money mainly through ads. To us, the consumers. To buy more things. Trillions of dollars of more things.

AI is a tool to be used, not a final product to be had. It’s only as valuable as what can be made and sold because of it.

So the major AI tech giants who are swallowing all of the capital in the market and need trillions to produce their tools are relying on demand for more stuff from regular consumers to give them returns on their investments. Riiiggghhhttt.

Let me grab my wallet.

Conclusion

It all feels so incredibly out of touch. Americans are struggling under the weight of inflation, cannot find jobs, and are depleting their savings accounts, while the government and market continue to invest in tech that will require us to fork over more money to make up the revenue? In the TRILLIONS? Printing $5.1B more dollars won’t help with that.

The check engine lights are on. Our attention is spent. Savings are gone. Wages are stagnating. Jobs are disappearing. I don’t think more AI-generated ads are what people need.

The outcomes of all of these decisions could go in multiple directions, but ultimately if the check engine light keeps getting ignored, the problems will grow. All the potholes could be paved over, but if the cars don’t work, no one will be driving. Something is bound to combust. Or pop?