Oregon’s new “Prosperity Plan” - will we finally prosper?

An analysis on Governor Kotek’s “Prosperity Plan” for Oregon and its implications.

Oregonians - this one is for you, as most of my reader base is in Oregon, and that’s where I live :) but the topics I’ll be breaking down apply to any state.

On December 5th, Oregon Governor Tina Kotek announced the new “Prosperity Roadmap” - essentially, a plan for economic development and job creation - my fav!

Before I started New Ropes, I was a program analyst for a local city’s economic development department. As someone who has studied and performed this work and been impacted by these types of policy decisions, I wanted to give my initial thoughts on the roadmap and where I see things headed.

The Prosperity Plan Roadmap

I went straight to the source to see what this plan is. The roadmap offers background information, the State’s strategic goals, and next steps the administration is taking to help Oregon ✨prosper✨.

Background

Oregon is struggling with the same problems as many other states right now, such as sluggish job growth, elevated unemployment, and declining population trends (that one is more Oregon-specific). These issues are compounded by business outmigration (businesses leaving the state, like Dutch Bros HQ and some others in recent years).

Economic and revenue forecasts provide three key areas to focus the work in: hiring, unemployment, and population. They also site studies from the University of Oregon and ECONorthwest provided to them which helped inform the roadmap, which I’ll get into in next sections.

Strategic Goals

The roadmap identifies three strategic goals for the state:

1) Accelerate Oregon’s Economic Growth: To target Oregon’s declining GDP, they want to increase the GDP growth rate from 1.7% to 2.2%. This would increase the general fund by $3 billion + through the 2029-2031 biennium (Oregon’s fiscal cycle).

To increase GDP, they’ll need more businesses to grow in Oregon and a growing population to generate more income tax. Considering this, it makes sense that this goal is set for 2029-2031, but it seems ambitious. Additionally, this first strategic goal seems more like an indicator of effectiveness for new economic development activities rather than focusing on what to actually fix. Cart before the horse, or however it goes…

2) More living wage jobs, now: They want to focus investments in “high-opportunity sectors”(aka manufacturing and tech mostly), expand workforce development programs, strengthen regional economic ecosystems, and leverage public-private partnerships. They propose a two-pronged approach that would increase partnerships with post-secondary education institutions (college/university/cert programs), local businesses, and the State to create new training and cert programs tailored to emerging industries so that employers could then launch hiring processes for newly created positions. Oregon was ranked #23 by the CNBC Workforce Ranking for 2025. Their goal is to place Oregon in the top 10.

These are well-known economic development tactics that are critical to improving economic conditions. Partnering with the private-sector to streamline hiring pipelines directly from educational institutions is key to developing and keeping a talented workforce in Oregon. From my personal research and experience working in the industry, something that often gets overlooked is ensuring employers also offer on-the-job training and hire for entry-level positions. Conversations around having an educated workforce while also offering hands-on experience will be important to have.

3) Retain and grow Oregon businesses: They plan to expand access to capital (create funds businesses can apply for), technical assistance (consulting services for navigating the ecosystem and accelerated permitting), and critical infrastructure. Their goal is to move from being ranked #39 by CNBC Top States for Business to top 10.

Of course, a focus needs to be on retaining and growing businesses in Oregon, and providing additional access to capital could help with this, but in order to do so they’ll need to build up those funds first, some how. This goal doesn’t address any incentives for businesses to do business in Oregon. It does help make doing business in Oregon easier, but many of the larger employers don’t need help, they want incentives to do business here (tax breaks, usually).

Next Steps

The roadmap outlines six next steps they’re taking to achieve these goals:

1) Recruit additional leadership and expertise to drive roadmap: Gov. Kotek established a Chief Prosperity Officer to expand and lead the strategic goals, and she’s establishing a Prosperity Council for additional guidance.

I think these are smart moves, as there has historically been no consolidated efforts in this field led at the state-level. Establishing a CPO and council signals Oregon’s efforts to prioritize economic development.

2) Establish new FastTrack Program: Introduce legislation in 2026 to remove “barriers to growth” and incentivize investment. Establish FastTrack program to support large projects with potential to create jobs/grow GDP, modeled after the Fed’s “FAST 41.”

The Federal Program “FAST 41” was created to speed up federal environmental reviews for infrastructure projects by improving coordination, transparency, and issue resolution. Streamlining our own infrastructure could help move things along and create more capacity to bring in businesses, but I wonder how they want to go about doing this.

3) Reduce Barriers to investment and growth: Streamline permitting services for businesses, expedite critical infrastructure (similar to step 2), and support local efforts to utilize unique regional resources, talent pools, and market opportunities.

Making business operations smoother is always good. Cumbersome administration is definitely a barrier to investment, but it’s not the only barrier businesses face.

4) Modernize and strengthen economic development tools: Update enterprise zones and strategic investment programs to make them more flexible, functional, and transparent. Business Oregon (the state’s economic development agency) will complete a state economic development strategy to address key topic areas: Capital Access and Entrepreneurship, Business Retention and Expansion, Business Recruitment, Workforce Development, Sector Alignment, Infrastructure, and Incentive Modernization.

Enterprise zones allow tax breaks for specific types of businesses and industries in particular areas that government wants to see developed. They often come with strings attached and difficult criteria to meet. Modernizing these tools would increase access for many smaller businesses especially.

5) Explore targeted tax changes to spur living wage job creation and increase GDP: The appointed council will develop recommendations to consider in 2027 legislative session aligned with strategic goals.

A major roadblock for businesses doing business here is the high taxes. Unless these are addressed, businesses will continue looking to states with lower taxes.

6) Partner with businesses and communities for results: Create a Global Trade Desk to expand opportunities for global commerce and promote Oregon as premier destination for foreign investment. Enhance business outreach with major employers to gather feedback and stay ahead of challenges.

Focusing on Foreign Direct Investment (FDI) is a strategic move. It is difficult to attract business from other states, but Oregon could show more favorable conditions for international firms looking to expand in the US.

Now that we understand the roadmap, let’s get into why Oregon is focusing on economic development.

Oregon’s Problems

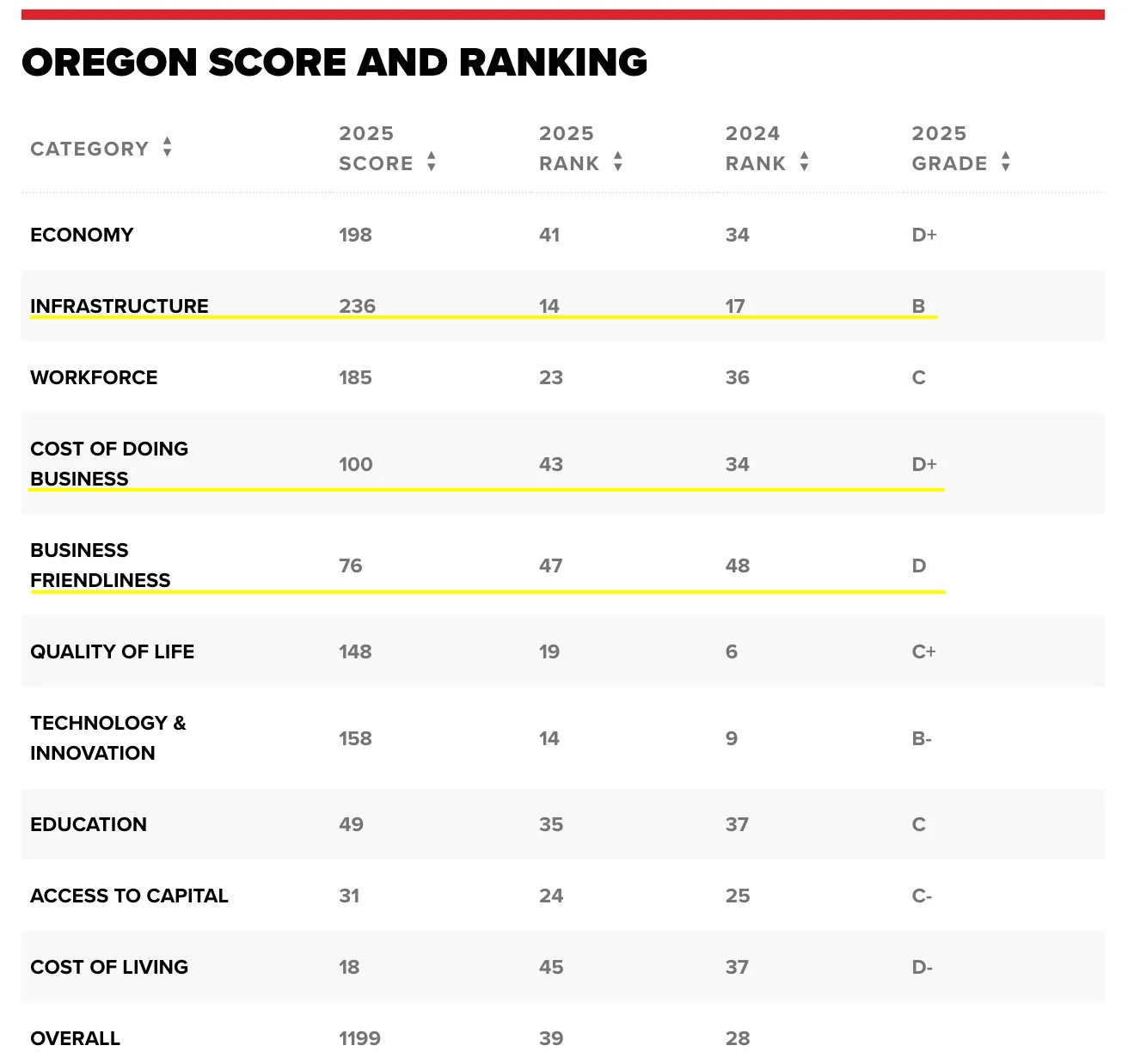

Oregon was ranked 39th on CNBC’s list for Top States for Business. They measure each state on 135 different metrics across 10 categories for competitiveness. Below is a picture of Oregon’s ranking across the 10 categories.

What I want to highlight here are infrastructure, cost of doing business, and business friendliness.

Under Steps 2 and 3 of the roadmap, they focus on building out infrastructure. It’s not a bad priority, but seeing our ranking at 14th, it doesn’t appear this is our biggest challenge for businesses. Increased infrastructure will allow for more growth, but in order to properly address problems, we need to critically look at what is causing them.

The two larger concerns for me are cost of doing business and business friendliness. Business friendliness is addressed quite a bit in the roadmap. It discusses strengthening regional hubs for economic development, performing more business outreach, streamlining permitting services, etc. - all tools that would target business friendliness.

What is really interesting is how Oregon went from 34th in 2024 to 43rd in 2025 for cost of doing business. What changed from 2024 to 2025 to drop us down 9 rankings? Well! Let’s start with 2019.

In 2019, Oregon was ranked 8th by the think tank Tax Foundation’s Tax Competitiveness Index. Since then, we have fallen to a ranking of 35th, due mainly to legislation that introduced the corporate activity tax (“CAT tax” we call it), beginning January 2020, to fund public schools. This tax, which many business owners groan about, compounds a tax pyramid where goods are taxed multiple times through the products lifecycle. It applies to individuals or businesses with more than $1 million in business receipts - gross income, not profit. This means businesses could owe taxes even if the receipts were unprofitable. That doesn’t really scream, “Come do business here!” now does it?

If money could fix everything, then this tax that is driving away businesses should have helped our school systems, but for 2025, WalletHub ranked Oregon 47th in the nation for education. Unfortunately, money does not fix everything — it needs to be coupled with intentional administrative reform.

UO Study

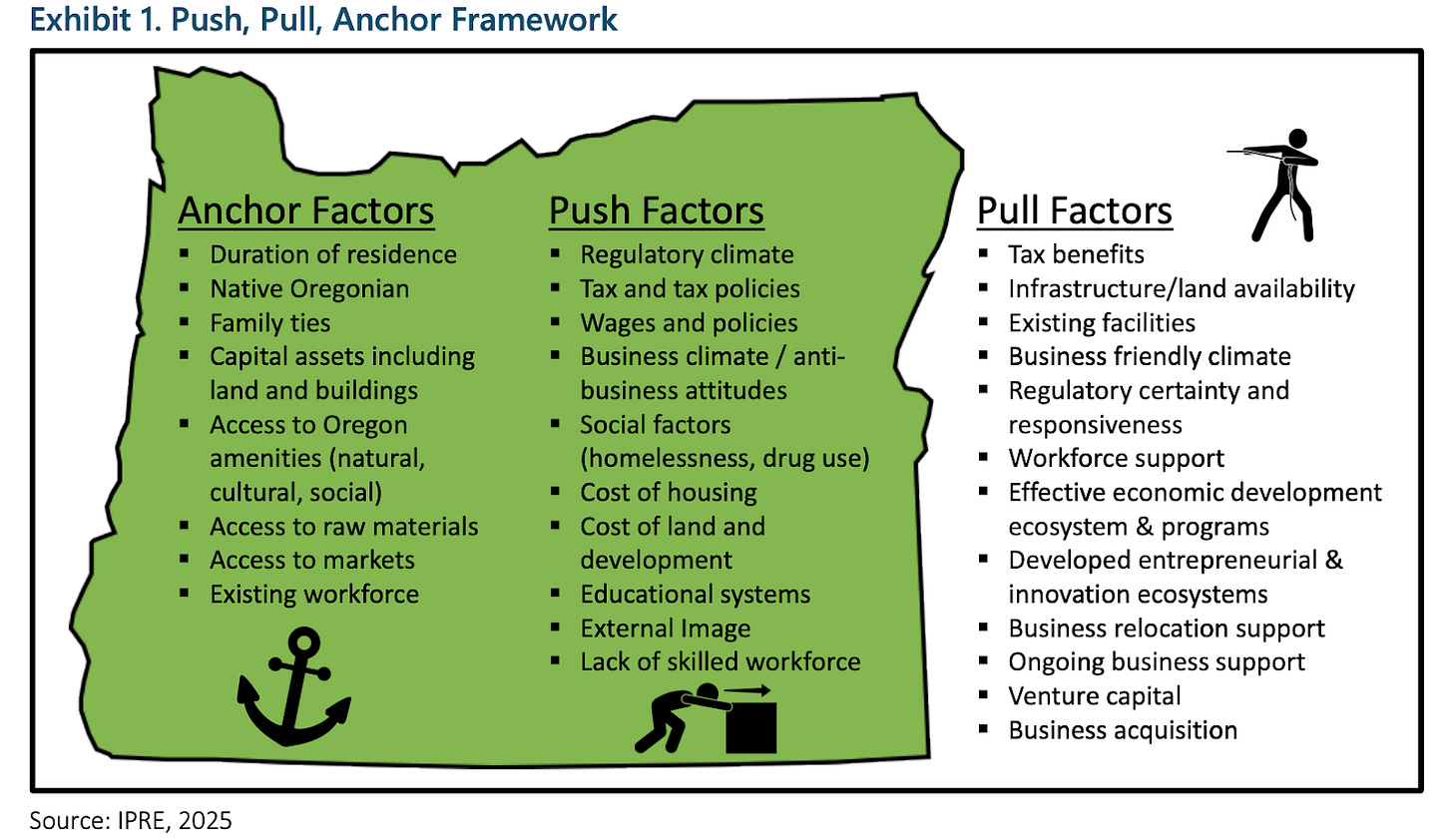

In a study performed by the University of Oregon for Business Oregon, they surveyed 393 traded-sector businesses and performed over 30 interviews with businesses and economic development organizations. They then put together the anchor factors (why businesses stay), push factors (whats pushing businesses away), and pull factors (whats pulling businesses away). I’ll include their graphic below:

You can see they also cite Oregon’s tax policies as a push factor for the state and tax benefits as pull factors for other states.

Their survey data showed that Oregon lost thousands of potential jobs and billions of potential private investments in the past five years and are poised to lose even more over the next five unless changes are made. Many businesses surveyed cited tax and regulatory burdens as to why they were leaving Oregon, as well as challenges attracting talent and unfavorable business climate. This has been especially true for manufacturing and tech firms.

They stated that Business Oregon’s tools for economic development activities are limited and in need of revamping. The effectiveness of their tools are limited by restrictive eligibility (no one qualifies for the programs), insufficient funding, slow implementation, and lack of awareness.

They provided four recommendations for Business Oregon:

1) Make business retention and expansion a priority: more competitive tax incentives, grants, and workforce development initiatives; improve communication and outreach with businesses proactively.

2) Work to improve Oregon’s business climate: address elements like high cost of living, regulatory challenges, and social issues; tax reforms and streamlined regulation; focus on infrastructure, education, and public safety.

3) Offer more cohesive leadership: embrace and prioritize economic development; link and align the 865 ec. dev. entities to coordinate efforts; take the long view on ec. dev.

4) Create more flexibility in use of Business Oregon programs: clear up the limitations for businesses to access support and resources; consider new or expanded incentives like awards based on performance; consolidate programs to focus on key strategies and measurability for effectiveness.

2025 Value of Jobs - State of the Economy by ECONorthwest

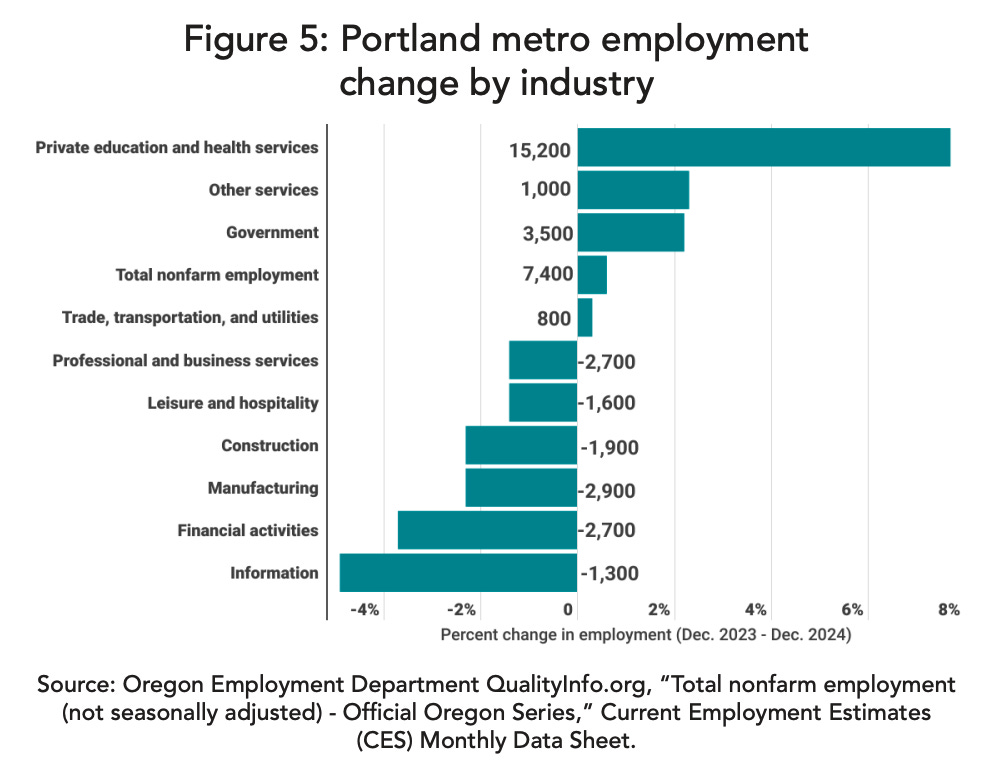

This report by ECONorthwest analyzes economic metrics for Oregon and specifically the Portland Metro Area. It discusses how Oregon is ranked 80th out of 81 in national real estate attractiveness. Jobs in the information sector dropped by 4.9% in 2024 and financial activities sectors declined 3.7%.

Clark county, across the river in Washington, and Clackamas county in the metro area are attracting higher-income residents, which started up-ticking in 2018, while Multnomah and Washington counties saw higher-income people leaving or staying (not moving in), with lower-income people moving in.

The report recommends the region to look into implementing policies and programs that bring costs down for business and residents and to look into policies that attract people to move in. A path for growth must be based on intentional growth strategies to attract talent and jobs that will help create a more stable revenue base.

Thoughts from an economic development girlie

As a born-and-raised Oregonian with a passion for economic development, I’m encouraged to see the steps Oregon is taking to create more jobs and better opportunities for Oregonians. Working hands-on in the industry has provided me insight into how these things will come to fruition, so here is where my mind is at:

Making Economic Development a state-wide priority

I am absolutely stoked Oregon is making moves to focus on economic development activities. Both ECONw’s and UO’s studies point toward a need to align ec. dev. agencies across the state and streamline efforts. It has always been obvious to me that in order to have a functional, well-running community, you need good jobs for people. Good jobs means needing businesses also interested in building the community.

I’ve been passionate about these efforts because I like taking a “teach a man to fish” approach to helping people (maybe its the coach in me?). Oregon has focused on implementing safety nets for its people while neglecting efforts to sustain those safety nets through increased business, workforce investments, and JOBS (leading to increased revenue). Welfare systems can’t support themselves without revenue, which is where Oregon is finding itself now. We need jobs. People want to work, but they can’t do that if there are no jobs. To create jobs, we need more business. And businesses need incentives, otherwise they’ll relocate to friendlier climates and take their jobs with them.

Coordinated and aligned Economic Development efforts across the state

When I worked in ec. dev., many of the recommendations talked about in these studies we were doing at the city level. We were outreaching to big employers, connecting with the university system to talk about certification programs and education-employer pipelines for talent, freeing up capital to assist local businesses to expand in the city, etc. Some of the challenges we faced were with business engagement and support from the larger ec. dev. ecosystem.

It was a department of three — now two, since my position was temp — and I felt a problem we faced was lack of leverage. Many businesses seemed uninterested in connecting with local government. We only had so much to offer for incentives, and our small department struggled to keep up.

A recommendation to Business Oregon was creating a one-stop-shop portal for businesses to access resources, capital, etc. This is a GREAT idea. If the State is able to establish a portal that all local government agencies and businesses can access, this would streamline efforts and free up capacity at local levels to work on more initiatives.

Working in isolation to improve economic conditions for a city was difficult. Residents of a city are also residents of a county, voting district, metropolitan area, and state - all of which have control over economic conditions, policies, and efforts that effect them. If efforts are coordinated across city departments, nonprofits, and other ec. dev. entities, then each entity will be stronger and better supported, and the businesses being reached will experience smoother programs and coordinated efforts.

Addressing the elephant in the room — taxes

It is ironic that the first strategic goal of the roadmap is to accelerate Oregon’s economic growth — GDP. To me, this acts as a better measure to see if economic development initiatives are being effective. If businesses grow and stay, and if the workforce becomes more aligned with the industries here, then naturally GDP will go up. Putting this as the first goal signals that their focus is simply creating additional revenue for the state. More taking, without the incentives.

Both studies cited high business taxes as a primary reason for businesses leaving the state. The only place the roadmap truly addressed this was in step 5 of their next steps, to explore targeted tax changes to spur living wage job creation and increase GDP. The new council leading these efforts must develop recommendations for the 2027 legislative session that aligns with strategic goals. Yet, in their strategic goals, they focus on wanting to create funds that businesses can apply for to help with growth… which would essentially be additional safety nets. Once again, we’re not thinking long term on how to build and maintain these safety nets. That must come first through attracting business investment and talent.

It’s obvious that Oregon is doing everything it can to try and address the challenges businesses are facing without evaluating clearly the single-biggest issue they point to — high taxes. Bottom-line, most businesses are only interested in reducing their overhead and increasing their margins. Without taking a hard look at tax policy, all of these efforts could fall short of attracting, retaining, and expanding businesses.

Conclusion

This is simply the beginning of a long journey for Oregon. The Roadmap was not meant to be conclusive, but to get things started and signal the direction Oregon government is taking things.

Overall, I feel encouraged that Oregon is finally addressing the need for better streamlined economic development tools. Establishing a Chief Prosperity Officer is a solid move in prioritizing ec. dev. and aligning agencies across the state. We will see once the 2027 legislative sessions comes around how they look at tax changes, and whether they listen to the voiced challenges of businesses here.

I’ll continue to analyze Oregon’s efforts on this journey, so stay tuned.

Sincerely,

Grace