Can employers have their cake and eat it too?

How a lawsuit brought against Uber and Lyft could change the landscape between employer-independent contractor relationships.

Classification whiplash

I have a friend who is a therapist. She works for a group practice as an independent contractor. Before she was a contractor, she was working for the same group practice, but as an employee. Before she was one of their employees, she was an independent contractor… for the same group practice. She’s had a bumpy ride and was sharing her grievances with me.

Nuances in the working world, like the difference between being an independent contractor vs a regular employee, were never discussed in our college courses. Some people are very familiar with the topic, especially those who’ve worked in manufacturing, driving and logistics, manual labor jobs, but many of us were never told how to navigate this sphere or what to look for when finding a job.

So let’s get into it - what does it mean to be a contract worker or a regular employee? And why are some companies so shady about these classifications?

There are many reasons why a company might want to classify a worker as a contractor rather than an employee. The work performed might not be needed for the company all year round. The company may want to avoid liability or reduce their payroll costs. In the case with my therapist friend, she gets paid like if she was an employee, but she has to set aside income for her own taxes, doesn’t receive the same support employees do, and she doesn’t accrue anything like PTO or sick days. If she’s sick and has to miss a client - no pay.

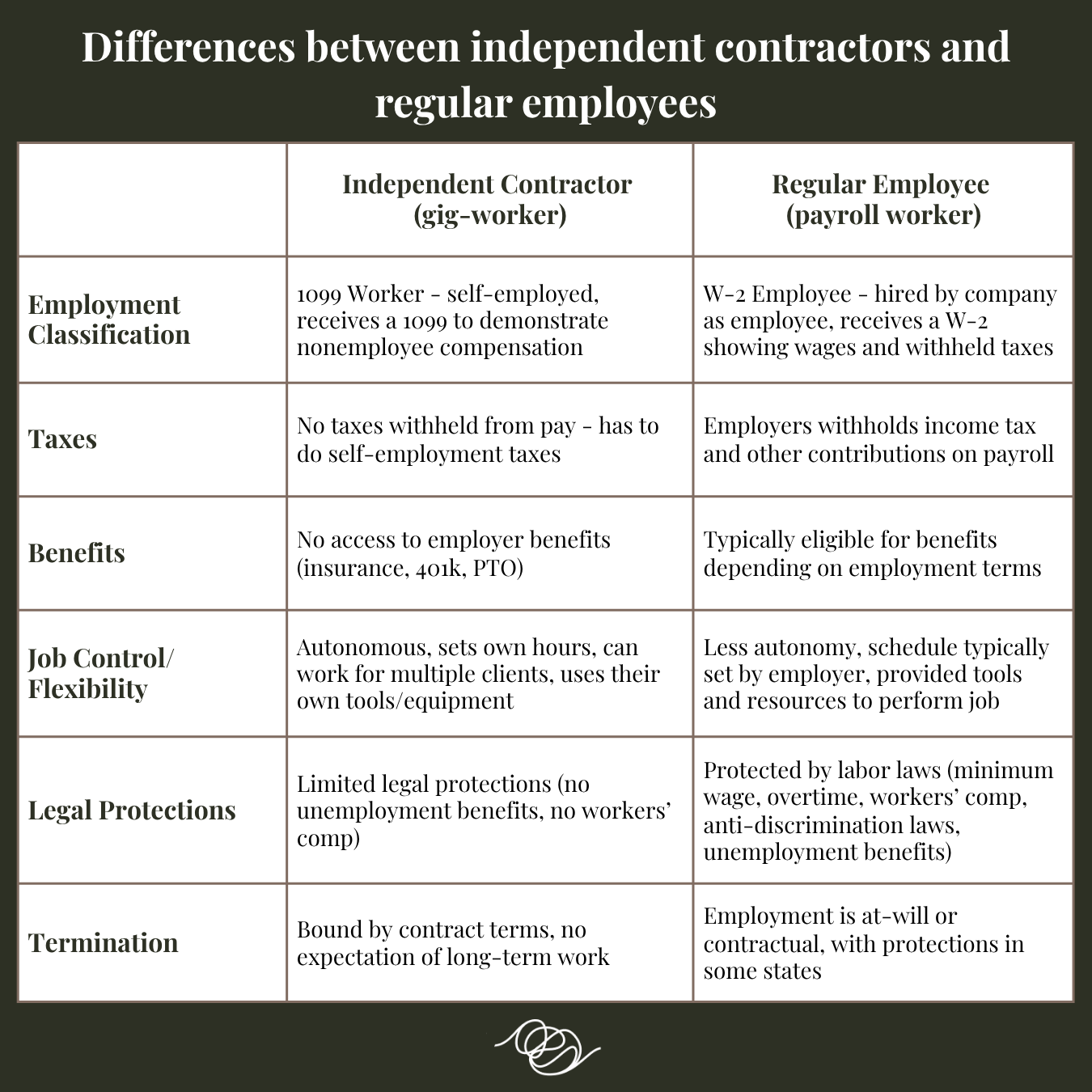

Spot the difference

Last week, I touched on the idea that people who are experiencing layoffs from companies could go into contracting for similar services that they were providing their previous employer. As a contractor, you have control over who you work for, what hours you agree to, and what services you offer. You’re essentially your own boss and responsible for your own success.

The downside? You don’t get reimbursed for costs you accrue (unless negotiated in a contract), you don’t get paid for hours you don’t work (PTO, holidays, OT), and you don’t receive the same protections regular W-2 employees get, like unemployment benefits if laid off.

Here’s a table to break it down:

To determine whether someone is truly an independent contractor or a regular employee, the IRS uses a “common law test” which focuses on the level of control or independence a worker has in 3 areas: behavior control, financial control, and type of relationship. If an employer exerts too much control, then the worker is likely a W-2 employee. Many of these controls are determined at the federal level under the U.S. Department of Labor (DOL), but many states also implement their own rules around worker classification.

In 2024, under the Biden administration, the DOL issued a final rule under the Fair Labor Standards Act (FLSA) that would force companies to treat some workers as employees rather than independent contractors, ruffling many feathers in the business world. The rule would require workers to be considered employees if they were “economically dependent” on the company they work for. The rule also adopted a standard which looks at several factors including the level of control companies exercise over the workers and if the work being performed is an integral part of the company’s business.

As of May 1, 2025, the Trump administration has rolled back that ruling and the DOL will return to determining employment classification based on a framework set by the FLSA in 2008. The impact of this new ruling is limited though, and time will tell how it gets implemented. Many states have their own independent contractor tests which expand on the fed’s and impose higher burdens on employers. Additionally, the DOL’s recent guidance is a temporary measure to be used until they develop what they deem as an appropriate independent contractor standard.

Employers will be watching closely to see how the standard will evolve / be implemented under the current administration, as new developments could mean big changes for employers familiar with (mis)classifying employees as independent contractors. Those in careers that are often contracted for work should also keep an eye on these changes and follow state rulings closely.

The Biden administration ruling was seen as employee-friendly and received a lot of pushback, especially from the right, because of the costs it would impose on employers. Keeping an employee on payroll (W-2) can typically cost a company 30% more than if they hired the worker as an independent contractor. As an employee, a company has to pay for unemployment insurance for them, health insurance, PTO, equipment reimbursements, etc. which can add up, leading companies to find work-arounds and loop-holes.

Things get murky when employers purposely misclassify workers as independent contractors instead of W-2 employees to skirt around spending and to save costs.

Still not employees, but not not employees either

The employer-contractor relationship is beginning to be reshaped, thanks to Uber and Lyft drivers in Massachusetts.

Last year, Uber and Lyft reached a $175 million settlement in Massachusetts for a class-action lawsuit brought against them by their drivers. In the suit, drivers were challenging their status as independent contract drivers for the companies, stating that they fall more under the category of employee - meaning the companies would need to change their relationship with the drivers significantly and offer more protections and benefits.

The case was brought against the companies in 2020 and was settled in 2024. Of course, like any case brought against large, influential companies with power and money, the case ended in a settlement, leaving alone the classification of the drivers as independent contractors. Based on the common law tests we mentioned previously, there was difficulty establishing independent contractor status, so they settled.

The prosecuting firm representing the drivers also withdrew their support for an independent-contractor ballot measure for the state. Shocking, I know.

While reclassifying the drivers as employees would have had major implications for all contract workers and had impacted all industries and the way workers are classified, the drivers didn’t walk away with nothing.

While still maintaining the contractor status, Uber and Lyft are now required to provide their drivers:

Guaranteed $33.48/hour for engaged (driving) time as of January 2025

Transparency to see the type of trip before accepting it (I guess they couldn’t before?)

Accrual of paid sick leave - 1hr per 30 driving, up to 40 hrs/yr

Accident insurance

Stipend for Paid Family & Medical Leave and health insurance

Better in-app support

+ $175 million paid out to drivers.

Not bad at all. A similar lawsuit was filed in California in 2013-2022 which settled at $20 million and did not win the drivers the same benefits.

The downside of a settlement is that the outcome of the case does not necessitate any changes to be made by any companies in similar circumstances. There is no court mandate to improve the benefits for all contractors, let alone impact them in other states.

What has been accomplished though is a new precedence has been set for what an employer-contractor relationship can look like. Drivers in other states could file similar class-action lawsuits against the companies, demanding similar respects and benefits, with a higher chance of success.

But for now, the benefits will be reaped by Massachusetts drivers. Congrats!

Why this matters

So, what does this mean for everyone else?

Well, the settlement could have ripple effects in paving the way for a more middle path between full employee status and independent contracting. Outside of just contract drivers, independent contractors could begin to pressure gig platforms to also offer earnings floors, paid sick leave, and benefits without requiring full employment classification. Other states can look at the way the case in Massachusetts ended and follow the same path to demanding better rights for independent contractors, before potentially facing similar lawsuits or legislation changes.

While there are pros to being an independent contractor like we discussed, there are also ways people can be exploited in their work and be taken advantage of, similar to my therapist friend’s story. Lines can get pretty blurry between what the real differences are between a regular employee and a contractor, besides just how the individual is classified.

Instances like these are common for therapists and many other careers. Class-action lawsuits, like the one brought against Uber and Lyft, could impact the flexibility companies have in classifying and reclassifying workers whenever it suits them best.

It will vary from state to state, but we’ve seen other lawsuits surfacing for similar reasons, especially in California (also shocking, I know). Lawsuits aren’t only coming from the workers, companies are being prosecuted by government institutions as well, accountability being demanded on all sides. San Francisco sued a delivery company for misclassifying their drivers as contractors. Companies are suing each other for misclassifying employees as independent contractors so they can pay them less and gain a competitive advantage.

The topic around worker classification is growing exponentially, and personally, I’m excited to see more light shown on the topic. I’m always a fan of large, powerful companies being challenged and held accountable for not compensating their employees. Actually, I’m a fan of any company/industry being held accountable for not compensating their employees.

Of course, not all independent contractors are taken advantage of - there are perfectly good reasons a company will hire contractors, and it works well for many situations. I currently contract out my services - I prefer being my own boss.

What is important to notice is when the lines get blurred and why - the reasons behind why a company classifies workers a certain way and the role the worker has in the company. (Mis)classification is important to pay attention to, especially if you’re an independent contractor.

Employers want to have their cake and eat it too, but maybe the tides are starting to change…

If you have personal experience navigating this issue or have thoughts on the topic, please leave them in the comments below, I would love to hear from you.